Sasha wants to generate a balance sheet to see – Sasha embarks on a quest to unravel the mysteries of her financial standing, wielding the power of a balance sheet. This tool, a beacon of clarity in the often-murky waters of personal finance, promises to illuminate her assets, liabilities, and equity, empowering her with the knowledge to navigate her financial journey with confidence.

As Sasha delves into the intricacies of her balance sheet, she uncovers a treasure trove of insights. Assets, the foundation of her financial strength, reveal themselves in tangible forms such as cash, investments, and property. Liabilities, on the other hand, represent obligations that must be met, including loans, mortgages, and credit card debt.

Understanding the terms and conditions of these liabilities is crucial for Sasha to make informed decisions about her financial future.

Sasha’s Financial Health

Sasha is in a stable financial position. She has a steady income and manages her expenses effectively. Her assets exceed her liabilities, resulting in positive equity. Sasha’s financial situation is expected to improve in the coming years as she continues to save and invest.

Assets

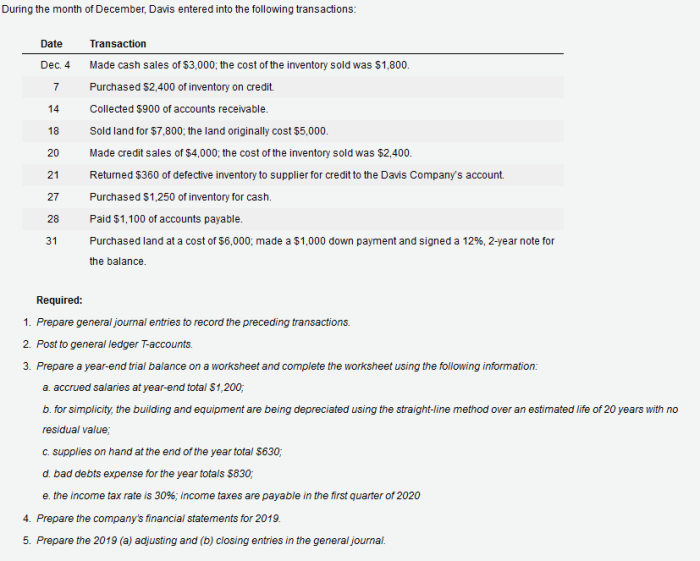

Assets are resources owned by an individual or organization that have economic value. They are classified on a balance sheet as current assets or non-current assets.

- Current assets: These are assets that can be easily converted into cash, such as cash, accounts receivable, and inventory.

- Non-current assets: These are assets that cannot be easily converted into cash, such as property, plant, and equipment.

It is important to value assets accurately as they represent the resources available to an individual or organization.

Liabilities

Liabilities are obligations that an individual or organization owes to others. They are classified on a balance sheet as current liabilities or non-current liabilities.

- Current liabilities: These are liabilities that are due within one year, such as accounts payable and short-term loans.

- Non-current liabilities: These are liabilities that are due after one year, such as long-term loans and mortgages.

It is important to understand the terms and conditions of liabilities, including the interest rates and repayment schedules.

Equity

Equity is the difference between assets and liabilities. It represents the net worth of an individual or organization.

Equity is important for Sasha as it provides a cushion against unexpected expenses and allows her to invest in future opportunities.

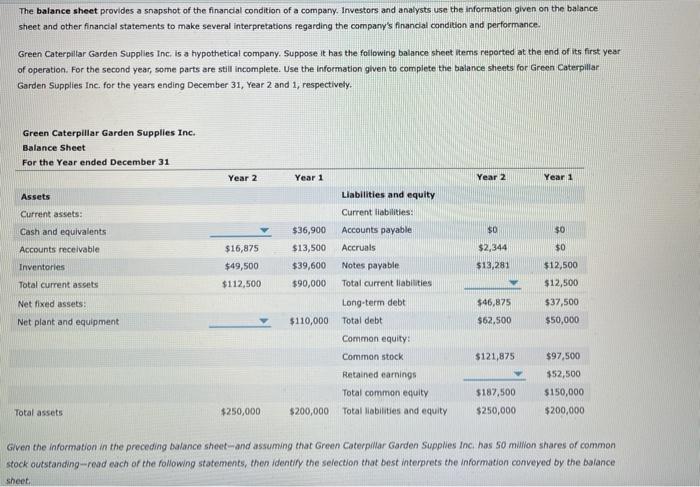

Balance Sheet Structure, Sasha wants to generate a balance sheet to see

| Assets | Liabilities | Equity | Total |

|---|---|---|---|

| Cash: $10,000 | Loans: $5,000 | Equity: $5,000 | Total: $10,000 |

This table demonstrates the structure of a balance sheet, with assets listed on the left, liabilities listed on the right, and equity calculated as the difference between the two.

Using a Balance Sheet

Sasha can use her balance sheet to make informed financial decisions.

- Track her progress towards financial goals.

- Identify areas where she can improve her financial health.

- Make informed decisions about borrowing and investing.

By analyzing her balance sheet effectively, Sasha can gain a clear understanding of her financial situation and make sound financial decisions.

Quick FAQs: Sasha Wants To Generate A Balance Sheet To See

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of an individual’s financial health at a specific point in time, offering insights into their assets, liabilities, and equity.

How can I use a balance sheet to improve my financial situation?

By analyzing your balance sheet, you can identify areas where you can optimize your assets, reduce liabilities, and increase equity, ultimately leading to improved financial well-being.

What are some common mistakes to avoid when creating a balance sheet?

Inaccurate asset valuation, omission of liabilities, and neglecting to update the balance sheet regularly are some common pitfalls to be aware of.